Americans continue to feel doubt and uncertainty as they face their financial futures

Today, few can count on pensions and similar sources of once-reliable retirement income

At the same time, increasing life expectancies can mean longer retirements, plus the risk of outliving retirement savings. With increased personal responsibility for their retirement funding as well as day-to-day finances, no wonder people are feeling more vulnerable to market downturns.

Methodology

Allianz contracted Larson Resea1ch and Strategy Consulting to field a nationwide online quantitative survey of 2,000 U.S. adults ages 35-67 with a minimum household income of $30,000. The sample was designed to achieve a 50/50 balance of men and women, and 50/50 balance of 1,000 boomers and Generation Xers.

Along with age and gender breakouts, the audience surveyed included four subgroups:

• Higher income

• Lower income

• Working with a financial professional

• Not working with a financial professional

We are income planners! CLICK HERE TO ASK US A QUESTION

Boomers and Gen Xers agree there is a

retirement crisis

– but there are generational

differences in how they’re responding

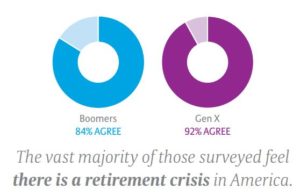

An overwhelming number of boomers and Gen Xers agree there is a retirement crisis (84% and 92%, respectively), and both groups reported being heavily impacted financially by the 2008 recession.

And although both groups see themselves as being hit harder by the recent recession, both generations agree that in general, it’s been much harder for Gen Xers to keep a job or plan for retirement.

Given that, it’s not surprising that more Gen Xers (29%) feel less optimistic about their financial future, compared to boomers (23%). And Gen Xers’ confidence about their retirement lifestyle is far worse, with 45% saying they weren’t sure they’d be able to live as they’d like to in retirement (versus just 32% of boomers).

Although these results may be disheartening, the good news is that both generations do believe it’s critically important for them to build their own financial security in retirement (94% of Gen Xers and 95% of boomers).

Also encouraging: nearly 50% of all respondents from both generations believe that working with a financial professional can have a significant positive impact on their finances and retirement readiness.

Read about the 9 discoveries made during this multi-generational study and how the responses are different

Conclusion

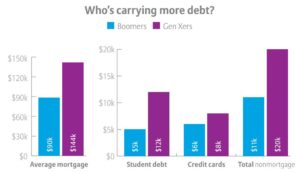

Boomers and Gen Xers are facing different financial challenges.

Every client is unique regardless of the generation they come from. That said, by understanding each generation’s widely held financial goals and concerns, the financial services industry can be better prepared to help boomers and Gen Xers plan for the future.

At the same time, it’s important for financial professionals to adapt their way of doing business to become more aligned with the expectations of both today’s and tomorrow’s clients.

The bottom line is that, no matter what their financial footing is today, members of both generations can benefit from working with a financial professional to develop better financial habits today- and to work toward a more successful retirement tomorrow.