The truth is…

The truth is, family is everything. Protect the ones you love with life insurance. #GetLifeInsurance #LIAM22

The truth is, family is everything. Protect the ones you love with life insurance. #GetLifeInsurance #LIAM22

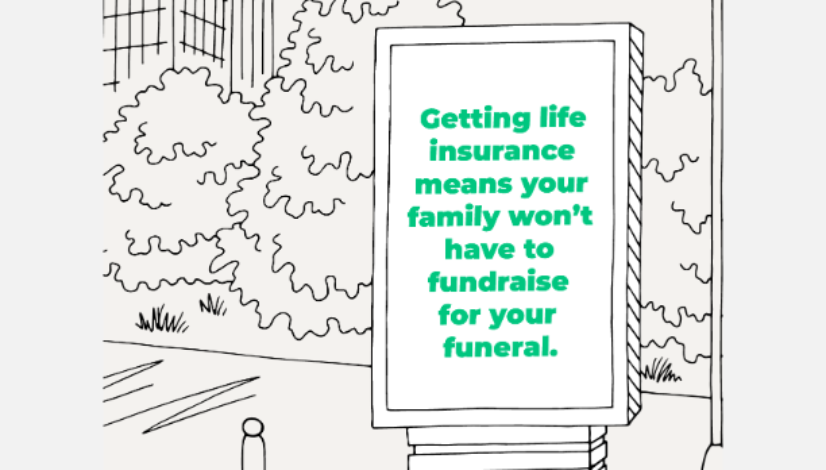

How many times have you seen someone raising money for a family who just lost a loved one? What if we said there was an affordable alternative that meant your family wouldn’t have to worry about finances while grieving? Solution: #GetLifeInsurance. #LIAM22

Happy Hispanic Heritage Month! Life Happens partnered with Argentine artist Eugenia Mello to create illustrations that show how life insurance is an easy decision. Life insurance isn’t for you, it’s for those who have to carry on without you. #GetLifeInsurance #LIAM22

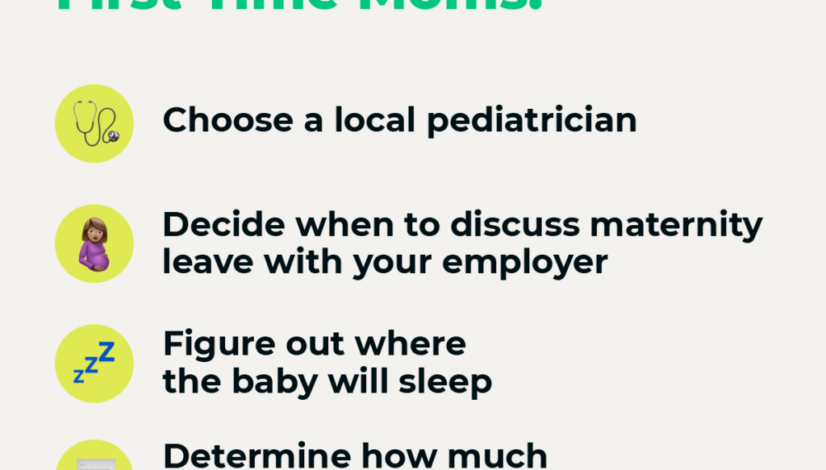

We get it—as parents, there are so many decisions to make, and it can feel like all of them are difficult! Everything you do is for your family. But thankfully, there is one choice that’s easy: getting life insurance to protect them financially. #GetLifeInsurance #LIAM22

What would your family do without your paycheck? If you don’t have life insurance yet, now is the time to get it. #GetLifeInsurance #LIAM22

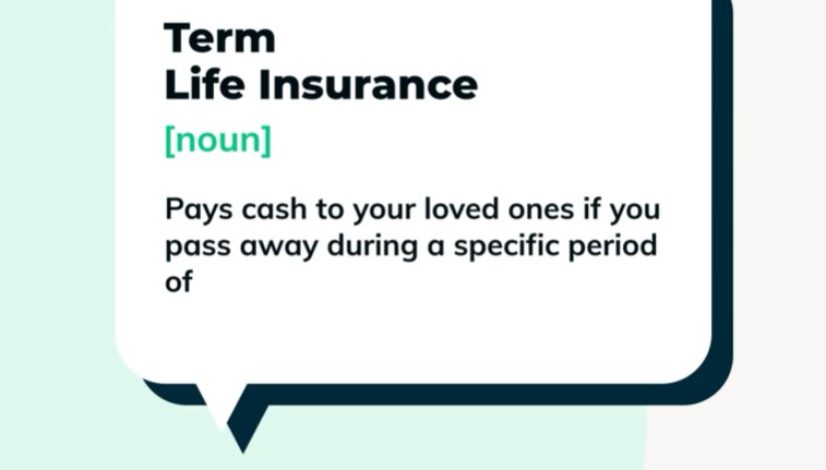

Term life insurance typically offers the most coverage for the lowest initial premium. It’s more affordable than you might think!

Our hearts go out to all of the families who lost loved ones on September 11, 2001. The Ogonowski family lost John, their husband, father, and brother, but he made sure his legacy lives on. #GetLifeInsurance #LIAM22

Big and small, there are so many choices to make for the ones you love. Fortunately, there’s one decision that’s easy: getting life insurance. Thank you to Roselyn Sánchez for helping us share this important message. #GetLifeInsurance #LIAM22

[Roselyn Sánchez is a paid partner of Life Happens.]

Is your family growing? Your need for life insurance is probably growing, too. Now is the time to talk to your insurance professional about options. #GetLifeInsurance #LIAM22