Start The Year On The Right Foot

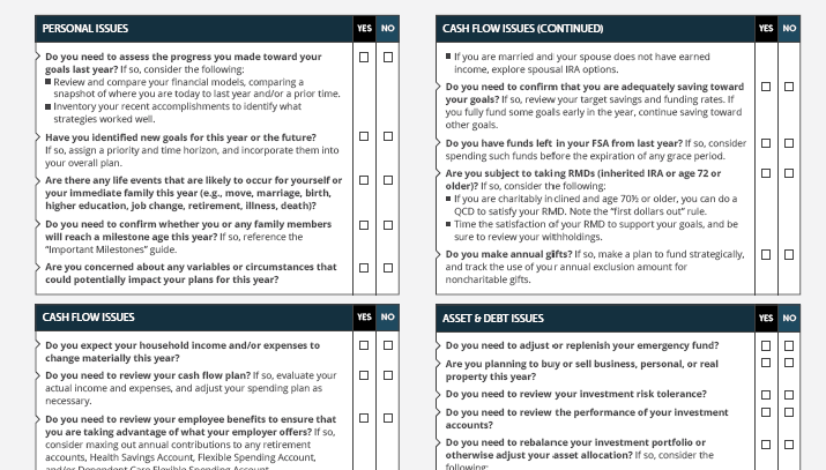

Start The Year On The Right Foot- The beginning of the new year is the perfect time to discuss the various factors influencing your planning. Click here for a guide

Start The Year On The Right Foot- The beginning of the new year is the perfect time to discuss the various factors influencing your planning. Click here for a guide

Full Article Provided By City National RochdaleKey PointsDemocratic presidential nominee Biden has taken the position that major provisions of the TCJA favor more affluent taxpayers and has offered a tax plan to address that perceived imbalance.President Trump believes that the TCJA temporary tax cuts were necessary to fuel economic growth and should be made permanent.Please […]

The SECURE Act included dozens of other provisions. Some went into effect immediately with the passage of the bill, and others were retroactive to the start of 2019. Many of these provisions will affect retirement, estate, and college savings plans.

Who is your primary beneficiary? As of January 1, 2020, new rules that are described in the SECURE Act will impact both beneficiaries and taxes for those people that have a substantial net worth contained in their IRA, and guess what? – the IRS is looking for a raise.

While we can’t make taxes go away completely we strive to have every client make purposeful decisions with tax implication consideration. This page contains information from various sources that will felt would help you. Remember to check back often as we will continue to update this through 2019