Is the retirement dream becoming more elusive?

Executive Summary

The U.S. retirement landscape has changed dramatically over the past few decades. Fewer workers today are eligible to receive a pension and instead must save for their own retirements, typically through workplace savings plans. Replacement rates for Social Security are declining due to the increase in the “full retirement age.”*

Income is becoming less predictable, thanks in part to new employment models. Health care costs are increasing, and so is longevity—which means workers today don’t just have more responsibility for saving for their own retirements, they also have to make those savings last, on average, for longer periods of time. In short, the new retirement landscape makes planning for retirement significantly more challenging than it had been in the past.

*Social Security benefits are expected to replace 36% of pre-retirement income in 2035, versus 39% in 2015. Alicia H. Munnell, Center for Retirement Research at Boston College, “401(k)/IRA Holding in 2016: An Update from the SCF,” 2017.

Have questions? Let us know!

The retirement dream is becoming more elusive

Many retirees are enjoying a secure retirement, but the “dream retirement” that many Americans once envisioned for themselves is becoming ever more elusive for pre-retirees, including Millennials, Gen Xers, and, to a lesser degree, Baby Boomers. The causes are varied: increasing longevity, the declining availability of pensions, increasing health care costs, an increase in the Full Retirement Age for claiming Social Security, and new employment models—such as gig work—that are making income less predictable.

PGIM Investments sponsored the 2018 Retirement Preparedness Survey to gauge how well individuals who are not yet retired are prepared for this new retirement landscape, and how they are responding to the challenges they face. We also looked at current retirees to see what types of actions and behaviors distinguish those who are living the retirement life they hoped for from those who have fallen short.

We discovered that each generation of pre-retirees is approaching retirement planning with their own unique mind-set and behaviors, reflecting the perspectives, experiences, lifestyles, and time to retirement of their members.* Attitudes vary widely in terms of how realistically they assess their retirement challenges and what they’re doing to address them.

Many of those surveyed are unsure about what steps to take to plan for retirement, and this uncertainty appears to be contributing to a disconnect between their retirement expectations and their actions. It is encouraging, however, that a majority of pre-retirees seem to recognize how the retirement landscape has changed and have adjusted some of their expectations for it. With additional education, advice, and planning, they have an opportunity to improve their retirement outlook.

*Generations are defined as: Millennials (21-37), Generation X (38 to 53), Boomers (54 to 72), and Matures (73 or older).

The 2018 Retirement Preparedness Study was conducted using an online survey among 1,514 adults living in the United States who met the following criteria:

• Age 21 and up

• Primary or shared responsibility in making household financial decisions

• Employed full-time or part-time, self-employed, a stay-at-home parent, or retired

The survey was conducted by The Harris Poll on behalf of PGIM Investments between January 18 and February 1, 2018.

What do you think?

Retirees are more likely to live the “dream retirement” if they…

The mass affluent category refers to individuals who have liquid assets above $250,000 and household income over $75,000.

Retirees living “dream retirement” offer clues to successful planning

Half of current retirees (51%) say they are living their “dream retirement.” Compared with those who aren’t living their dream retirement, these individuals are more likely to have pensions and diversified sources of income. They also are more likely to have been able to retire at their planned retirement age.

Not surprisingly, wealth factors into the degree to which people are happy with their retirement lifestyle. While 51% of current retirees overall say they are living their dream retirement, those defined as “mass affluent” are much more likely to feel this way—71% of the mass affluent say they are living their dream retirement.4 (See Figure 1)

But some less-affluent retirees are “living the dream” too. Thirty-seven percent of retirees who do not qualify as mass affluent say they are living their dream retirement, indicating that even with lower incomes and smaller investment account balances, a comfortable retirement is possible with the right planning and mind-set.

Many retirees living their dream retirement share financial best-practice behaviors compared to those who are less satisfied in retirement:

• Started saving six years earlier, on average

• More knowledgeable about investments

• Show more willingness to take risks

• More likely to use a financial advisor

Average age started saving…

The top lessons retirees would pass on to today’s pre-retirees are: save more, start saving earlier, and plan on retiring later. These controllable financial behaviors are becoming increasingly important in the new retirement landscape, which places more of the responsibilities and risks for funding retirement squarely on the individual.

Pre-retirees’ expectations of when retirement will be possible are changing

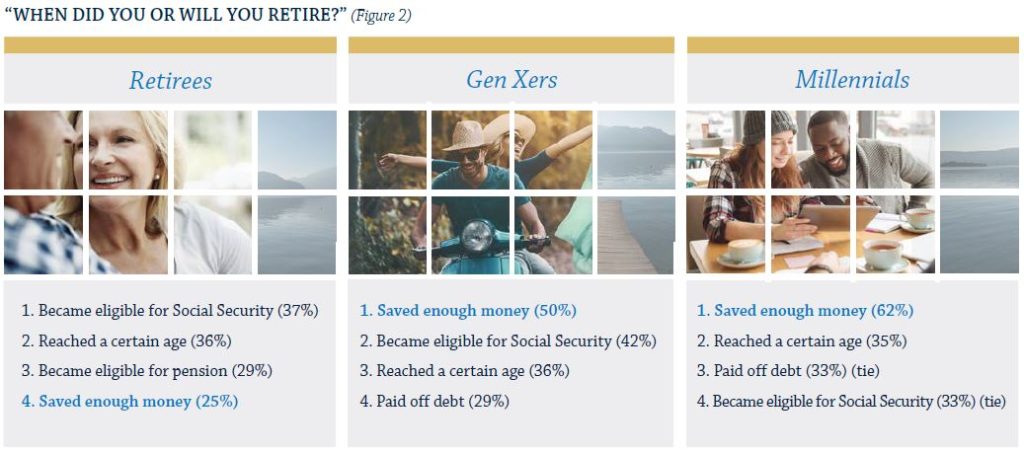

Pre-retirees are more likely to base their decision about when to retire on their wealth rather than their age.

Current retirees decided when to retire largely based on their age and eligibility for Social Security and pensions. As the retirement plan market has shifted to one dominated by defined contribution savings plans rather than defined benefit pension plans, pre-retirees are focused less on reaching a certain age to retire and more on reaching a certain level of wealth. (See Figure 2)

Half of Gen Xers and nearly two-thirds of Millennials say they will retire when they have saved enough money.

By contrast, only a quarter of current retirees based their decision about when to retire on how much they had saved.

Compared to previous generations, pre-retirees are more focused on paying off debt as a prerequisite for retirement. About a third of pre-retirees rank “paying off debt” as one of their top four retirement-planning challenges. By contrast, this was not a high priority for current retirees. Overall debt levels for households nearing or already in retirement are higher compared to past generations—68% of households with heads age 55 or older carried debt in 2016, up from 54% in 1992.* Paying off debt will likely become more important for each subsequent generation due to the ballooning of student loan debt. Student loan debt often forces young couples to put off purchasing a house as well as putting down a large down payment when they do. As a result, we can expect even more mortgage debt to be carried into the retirement years.

*EBRI, “Debt Levels for Households Nearing Retirement Decreasing, but Still High Compared to Past Generations,” 2018.

Pre-retirees are rethinking their sources of retirement income

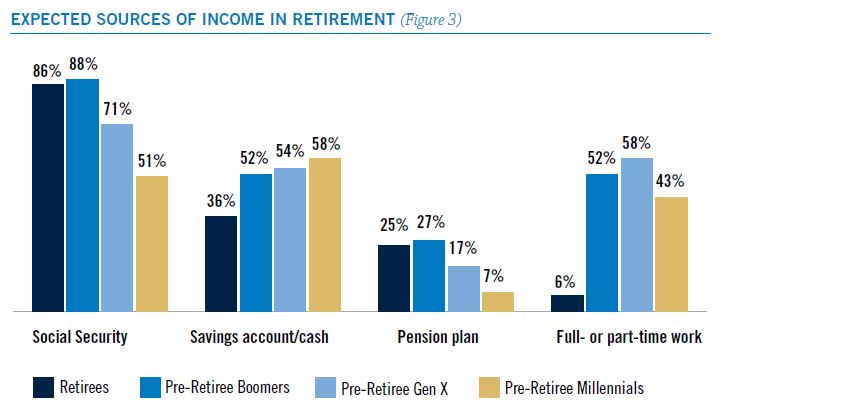

Younger pre-retirees are less optimistic that they will receive Social Security benefits. Eighty-six percent of current retirees count Social Security benefits as a source of income, and 61% say it is their most critical source of income and that they could not stay retired without it. By comparison, only 70% of Gen Xers and 51% of Millennials expect to receive Social Security benefits when they retire.

Younger pre-retirees also have little expectation of receiving pension income in retirement. Only 7% of Millennials expect to receive a pension, down from 17% of Gen Xers and 25% of current retirees. Interestingly, pre-retiree Baby Boomers are slightly more optimistic than current retirees that they will receive pension and Social Security income in retirement—by two percentage points in each case.

Because they expect to rely less on Social Security and pensions, pre-retirees are planning to have more sources of income in retirement than current retirees. Pre-retirees anticipate having, on average, 3.3 sources of income, compared with 2.6 for current retirees. Anticipated income sources include Social Security, savings, pensions, and employment. (See Figure 3) Over half of pre-retirees (51%) expect to generate retirement income by working full- or part-time in “retirement,” compared with only 6% of current retirees. This may be linked at least in part to pre-retirees’ reduced expectations for Social Security and pension income.

More pre-retirees expect to generate retirement income from their savings accounts or cash than current retirees, making investing—and good investment solutions—increasingly important to achieving

retirement goals.

Pre-retirees’ expectations for how they will spend their retirement are changing

Retirees and pre-retirees share the same top four goals in retirement: relaxation, travel, family time, and leisure activities. These still represent the fundamental characteristics of a dream retirement.

However, pre-retirees are more inclined to want to do something new in retirement. Nearly four in 10 pre-retirees (39%) say they want to volunteer after they stop working. And while they are clearly in the minority, a notable11% want to start a new business, 7% want to start a new career, and 6% want to study something new or go back to school. To some extent, these goals may tie into expectations of needing to work after retirement age to generate income.

Pre-retirees worry about uncertainties that could have a negative impact on their retirement. Their top concerns are:

• Health care costs (cited by 57% of pre-retirees)

• Changes to the Social Security program (46%)

• Illness or disability (45%)

• Inflation (30%)

Overall, Gen Xers are more concerned than Millennials about most of these items, and are significantly more concerned about health care costs and Social Security. However, Millennials are more likely than Gen Xers to worry about losing their jobs, the impact of tax reform, or needing to care for loved ones. These items may resonate more with Millennials because these issues are, in general, not as far off in the future as the major concerns of Gen Xers.

Pre-retirees’ concerns about losing a job aren’t unfounded—51% of retirees say they retired earlier than expected. Of that group, half say they retired more than five years earlier than planned. In many cases, the reasons were involuntary, including health problems (cited by 29% of the early retirees), layoffs or restructurings (14%), the need to care for a loved one (13%), and the inability to find a new job (10%). Not surprisingly, involuntary early retirement takes its toll, with 47% of those who had to do it saying it had a major to moderate negative impact on them financially. The lesson for pre-retirees: Expect the unexpected, especially if you are among those counting on generating income by working after reaching retirement age.

The 2018 Retirement Preparedness Study was conducted using an online survey among 1,514 adults living in the United States who met the following criteria:

• Age 21 and up

• Primary or shared responsibility in making household financial decisions

• Employed full-time or part-time, self-employed, a stay-at-home parent, or retired

The survey was conducted by The Harris Poll on behalf of PGIM Investments between January 18 and February 1, 2018.

Pre-retirees often aren’t preparing enough for retirement—or just don’t know how

Have questions? Let us know!

Getting started is often the hardest part of preparing for retirement.

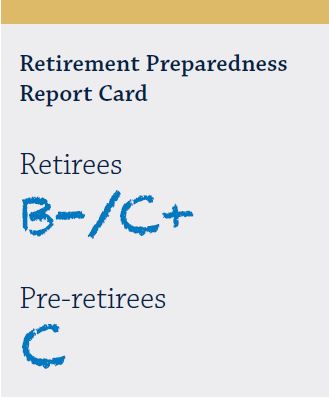

Pre-retirees have difficulties estimating how much monthly income they will need in retirement and how much they need to save for a secure retirement. When asked about their level of retirement preparedness, pre-retirees on average gave themselves a “C,” while current retirees graded themselves at “B-” or “C+.”

About two in five pre-retirees are “not at all sure” about how much monthly income they will need in retirement.

Of those who did provide an estimate, 53% based it on their current monthly living costs and 43% on a “best guess.” Only 24% used an online retirement calculator and/or spoke with a financial advisor to inform their estimates. To be fair, uncertainty about future costs is not uncommon. In fact, 75% of current retirees are unable to say how much they are spending monthly, even though they cite “covering basic monthly expenses” as their top financial goal.

About two in five pre-retirees are “not at all sure” about how much monthly income they will need in retirement.

Of those who did provide an estimate, 53% based it on their current monthly living costs and 43% on a “best guess.” Only 24% used an online retirement calculator and/or spoke with a financial advisor to inform their estimates. To be fair, uncertainty about future costs is not uncommon. In fact, 75% of current retirees are unable to say how much they are spending monthly, even though they cite “covering basic monthly expenses” as their top financial goal.

Pre-retirees have trouble conceptualizing how much money they need to save for retirement.

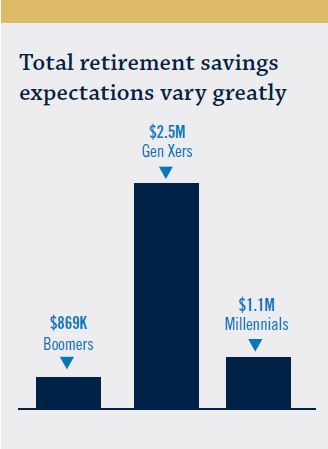

This isn’t particularly surprising given that many have little idea about how much income they’ll need. More than half the pre-retirees surveyed (53%) would not even venture a guess as to how much they will need. Of those who did, Gen Xers had the highest average estimate at $2.5 million, followed by Millennials at $1.1 million, and Boomers at just $869,000. Gen Xers’ estimates may be significantly higher than Millennials because Gen Xers are more concerned about health care costs and the sustainability of the Social Security program—issues that may be looking more “real” to them as they approach retirement. Millennials, on the other hand, report fewer long-term concerns, which may lead them to underestimate the magnitude of their challenges to having a financially secure retirement.

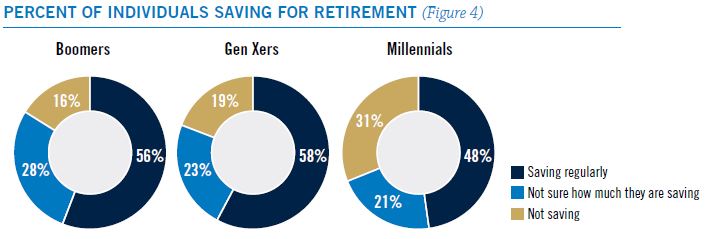

Astonishingly, 25% of pre-retirees are not sure how much they are currently saving for retirement. Meanwhile, nearly one in five Gen Xers and one in three Millennials aren’t saving for retirement at all.

(See Figure 4) The top two reasons these groups cite for not saving are that they “do not have enough extra money to save” and that they “have other financial priorities right now”—even though pre-retirees list “saving for retirement” as their top savings goal.

Knowledge can help close gaps between retirement expectations and actions

Many actions taken by pre-retirees fall short of what is needed to fund a secure retirement. Understanding these disconnects—and potential solutions—could help them close those gaps. Among the major gaps uncovered by the survey are these:

Millennials vs. Gen Xers: Different attitudes, approaches to retirement planning

Generational differences in approaches to retirement planning reflect each generation’s perspectives, experiences, lifestyles, and length of time to retirement.

Millennials are unsure about retirement—excited and frightened at the same time. This may be because they are not even sure about the direction of their own careers, family needs, and cost structures, which makes it more challenging for them to envision their retirement needs. Forty percent of Millennials agree that they have plenty of time until they retire, so they don’t have to think about it yet. And 35% agree that “anything can happen from now until I retire, so I don’t see the point of planning.”

Gen Xers have a clearer vision of what to expect in retirement, probably because it is more imminent for them. On the other hand, Gen Xers’ career paths, family needs, and financial situations may be fairly well set, leaving them with less flexibility to make changes. Having fewer years left to adjust their behaviors and saving patterns could be problematic for some. Even though Gen Xers are more realistic than Millennials about how much they need to save for retirement, for example, 19% say they are not saving at all and 23% say they aren’t sure if they are saving. Finally, four in 10 say they don’t know what to do to prepare for retirement or how to do it.

More on Millennials’ Outlook

The survey’s findings on Millennials are consistent with those from Prudential’s “80-Year-Old Millennial Study.” Nearly 80% of Millennials in this newest survey believe “people will no longer be able to retire comfortably in the future.” Almost two-thirds agree that “traditional full-time employment will largely disappear, and freelancers will

make up 75% or more of the U.S. workforce.”

Takeaways

Individuals, advisors, and employers can all play a role in helping pre-retirees adapt to the new retirement landscape and improve their retirement preparedness. Individuals should:

• Work with a financial advisor to establish a customized retirement plan that estimates monthly expenses in retirement, establishes how much is needed to cover those expenses, and sets saving goals.

––Financial advisors should help individuals make realistic estimates about their ability to earn predictable income from work both during their working years and in retirement, and think about how long-term career planning may intersect with retirement planning. Any retirement plan should include buffers to account for unexpected developments.

––Financial advisors can adjust their approach to working with different generations of Americans to account for their differing mind-sets. When working with Millennials, for example, who can’t easily visualize retirement, advisors might create retirement plans that include a series of smaller steps with achievable short-term and long-term goals. Advisors can schedule frequent checkups with their clients to track progress toward these smaller goals along the journey to retirement.

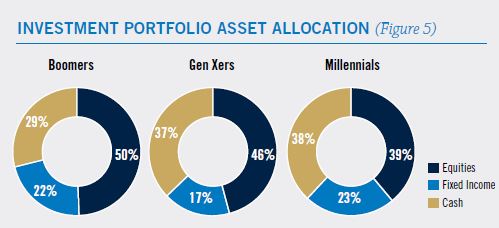

• Leverage financial wellness education programs, financial counseling services, and financial planning tools provided by employers to learn how different investment solutions can help them achieve goals. Among the possible solutions: target date funds, which may provide preretirees with an asset allocation glidepath suitable for their life stage.

• Consider investing in their employer’s Qualified Default Investment Alternative, or QDIA. Employers who have not already done so can select a QDIA as the default investment option for employees who are automatically enrolled in their retirement savings plans. The most popular QDIAs today are target date funds. Two out of three pre-retirees (68%) say they would most likely use their plan’s QDIA and invest in a target date fund.* Based on the 68% that said they are most likely to take their employer ’s recommendation to be automatically enrolled in an investment designed to evolve with them over time.